kirschen-instrument.ru

Community

Chase Online Check Deposit Limit

Chase Quick Deposit has a daily limit of $2, for check deposits to ensure the security and reliability of the service. This limit helps. Sign in through the Chase Mobile® app on your mobile device · Choose “Deposit Checks” from the navigation menu · Choose the deposit account · Type in the check. Chase QuickDeposit℠ is subject to deposit limits and funds are typically available by next business day. Deposit limits may change at any time. Other. For a 2% service fee ($5 minimum), your money will be available on the spot. Online Advertising · Terms of Use · Security · About Us · Accessibility · Careers. Pay bills; Transfer Money; Remotely Deposit Checks; Find a Retail Center or ATM. For making mobile check deposits, PrimeWay's mobile app offers a Remote Deposit. With Chase QuickDeposit Scanner, our remote deposit solution, you can scan your paper checks and send the scanned images to Chase for deposit into your. Depending on your bank, you may also have a daily deposit limit. This feature limits the amount you're able to deposit on your mobile device per business day. Chase QuickDeposit lets you deposit checks through the mobile app. To use Break free of the shorting restrictions, day trading rules, and account minimums of. Sign in to the Chase Mobile® app, select Deposit checks and your account, then select Learn more to view your limits. Footnote 2. Chase Mobile® app is available. Chase Quick Deposit has a daily limit of $2, for check deposits to ensure the security and reliability of the service. This limit helps. Sign in through the Chase Mobile® app on your mobile device · Choose “Deposit Checks” from the navigation menu · Choose the deposit account · Type in the check. Chase QuickDeposit℠ is subject to deposit limits and funds are typically available by next business day. Deposit limits may change at any time. Other. For a 2% service fee ($5 minimum), your money will be available on the spot. Online Advertising · Terms of Use · Security · About Us · Accessibility · Careers. Pay bills; Transfer Money; Remotely Deposit Checks; Find a Retail Center or ATM. For making mobile check deposits, PrimeWay's mobile app offers a Remote Deposit. With Chase QuickDeposit Scanner, our remote deposit solution, you can scan your paper checks and send the scanned images to Chase for deposit into your. Depending on your bank, you may also have a daily deposit limit. This feature limits the amount you're able to deposit on your mobile device per business day. Chase QuickDeposit lets you deposit checks through the mobile app. To use Break free of the shorting restrictions, day trading rules, and account minimums of. Sign in to the Chase Mobile® app, select Deposit checks and your account, then select Learn more to view your limits. Footnote 2. Chase Mobile® app is available.

Chase QuickDeposit℠ via the J.P. Morgan Mobile app: for mobile check deposits · Sign in to the J.P. Morgan Mobile app · Tap "Pay & Transfer" · Tap "Deposit checks". mobile check deposits Deposits made through the Chase Mobile® app are subject to deposit limits and funds are typically available by the next business day. Maximum daily external transfer limit of £25, 1. From 8 October To bank with Chase, you'll need to: be 18+; be a resident of the UK only; have. The Chase QuickDeposit application lets users who are enrolled in Chase Online, pay bills and credit cards via their handset using their camera phone. The. With Chase QuickDeposit, make a mobile check deposit almost anytime, anywhere with the ease of taking a picture. Another convenience of mobile banking. Generally, a bank must make the first $ from the deposit available—for either cash withdrawal or check writing purposes—at the start of the next business. • Check deposit with teller or at ATM – usually the next business day Online Overnight CheckSM Service Fee: See kirschen-instrument.ru for details. Effective. Chase Mobile® app is available for select mobile devices. Message and data rates may apply. Deposit products provided by JPMorgan Chase Bank, N.A. Member FDIC. Deposits made through the Chase Mobile app are subject to deposit limits and funds are typically available by next business day. Deposit limits may change at. Deposit products and related services are offered by JPMorgan Chase Bank, N.A. Member FDIC. Equal Housing Opportunity. Investing involves market risk, including. Sign in to the Chase Mobile® app, select Deposit checks and your account, then select Learn more to view your limits. Footnote 7. Chase QuickDeposit℠ (with. By law, banks are required to make at least the first $ of a personal check deposit available for use by the next business day FootnoteOpens overlay. Note. Use the Chase Mobile® app FootnoteOpens overlay, FootnoteOpens overlay to securely deposit checks with the snap of a photo. Limits apply. OR scan the QR code. For that much money, I'd do a wire transfer (fee is about $17) or certified check (also a small fee) or see if you can get a direct deposit. Deposit limits may change at any time. Other restrictions apply. See kirschen-instrument.ru or the Chase Mobile® app for limitations, terms, conditions and. JPMorgan Chase Bank, N.A. Member. FDIC. All services are subject to If you make a check deposit through a mobile device, Remote Deposit Capture Mobile can be. Deposit limits may change at any time. Other restrictions apply. See kirschen-instrument.ru or the Chase Mobile® app for eligible mobile devices, limitations. There is no minimum deposit to open this account, and you have unlimited electronic deposits. Customers have up to $5, fee-free cash deposits per cycle and. Endorsement requirements may vary from bank to bank, as well as if you're depositing the check through your bank's mobile app. You may need to include your. Mobile check deposits are subject to verification and not available for immediate withdrawal. Other restrictions apply. In the Mobile Banking app menu, select.

Borrow From Whole Life Insurance

:max_bytes(150000):strip_icc()/understanding-life-insurance-loans.asp-Final-c9eda1aebe3141a0b58658374dd5c7c5.jpg)

Yes, a permanent policy will allow you to borrow against the cash value. The cash value will always be less than your first years payment . This value can be borrowed against or withdrawn, but doing so may reduce your death benefit and could risk policy lapse. Benefits: Cash value life insurance. You can generally borrow money from your life insurance policy once the cash value component has met a certain minimum threshold. So, does this mean I can get whole life insurance this month and take a loan next month? No. What you're actually borrowing are the premiums you and your spouse. The limit for borrowing money from life insurance is set by the insurer, and it's typically no more than 90% of the policy's cash value. When your policy has. Insurers generally allow you to borrow up to 90% of 95% of your cash value amount. Do I have to pay back loans on life insurance? Once the cash value of your permanent life insurance policy reaches a certain level, you will be able to take out a loan against it. Many policy owners reserve. If you don't borrow from the cash value, your beneficiary will eventually receive the full amount as a tax-free payout. (But keep in mind that loans and. That cash value typically will be enough to borrow against in about 10 years, according to Richard Reich, president of Intramark Insurance Services, Inc., a. Yes, a permanent policy will allow you to borrow against the cash value. The cash value will always be less than your first years payment . This value can be borrowed against or withdrawn, but doing so may reduce your death benefit and could risk policy lapse. Benefits: Cash value life insurance. You can generally borrow money from your life insurance policy once the cash value component has met a certain minimum threshold. So, does this mean I can get whole life insurance this month and take a loan next month? No. What you're actually borrowing are the premiums you and your spouse. The limit for borrowing money from life insurance is set by the insurer, and it's typically no more than 90% of the policy's cash value. When your policy has. Insurers generally allow you to borrow up to 90% of 95% of your cash value amount. Do I have to pay back loans on life insurance? Once the cash value of your permanent life insurance policy reaches a certain level, you will be able to take out a loan against it. Many policy owners reserve. If you don't borrow from the cash value, your beneficiary will eventually receive the full amount as a tax-free payout. (But keep in mind that loans and. That cash value typically will be enough to borrow against in about 10 years, according to Richard Reich, president of Intramark Insurance Services, Inc., a.

Borrowing from your universal or whole life policies can be done when the minimum contracted cash value is achieved. Life insurance as an asset class grows. 2-If your life insurance is individually owned “permanent” insurance (whole life, universal life, variable life, etc), you can borrow (or. Whole life insurance lets you borrow at low rates with no credit check or fixed repayment date. In some cases, you may not owe taxes on borrowed amounts, and. If you do not pay the premium for your term insurance policy, it will generally lapse without cash value, as compared to a permanent type of policy that has a. Aflac offers whole life insurance with cash value that you can borrow against in the form of a loan. These life insurance loans can help pay for medical. You can only borrow against a permanent life insurance policy, meaning either a whole life insurance or universal life insurance policy. Your policy will grow in value at a guaranteed rate, and you can borrow against it if you choose. Why it's popular. Whole life could be right for you because. You can borrow up to the maximum loan value from your policy's cash value through policy loans, generally on a tax-free basis3. You can receive your cash value. In a Nutshell: Life insurance policy loans are a way to borrow against your life insurance policy to provide financial flexibility and freedom. Term life insurance policies provide a death benefit, but have no cash value component. You can borrow money from a permanent life insurance policy once the. If you've had your life insurance policy for several years, the insurance company will often allow you to borrow from your policy's cash value. In most cases. During life, many whole life policies have provisions to borrow a portion of the accumulated cash value. If a policy is terminated without the insured dying. Cash value can be withdrawn in the form of a loan or it can be used to cover your insurance premiums. All loans must be repaid before you pass or they will be. Can I take a loan from my policy and what is the impact? Build cash value: Whole life typically offers the ability for you to build cash value you can potentially borrow against or use for other financial needs. Term. A policy loan is a feature that allows you to borrow money against the cash value that has built up within your life insurance policy over time. You can borrow about 95% of the cash value amount of your whole life policy from most mutual insurance companies. And when you borrow against your insurance. Some life insurance policies earn cash value, and those are the types of insurance policies you can borrow from. Whole life insurance and universal life. This life insurance loan may include the portion of your paid premiums that have been designated for the cash value account, along with any accrued interest. You won't have to pay taxes on the loan as long as your policy stays in force A whole life insurance policy pays dividends. One of the benefits.

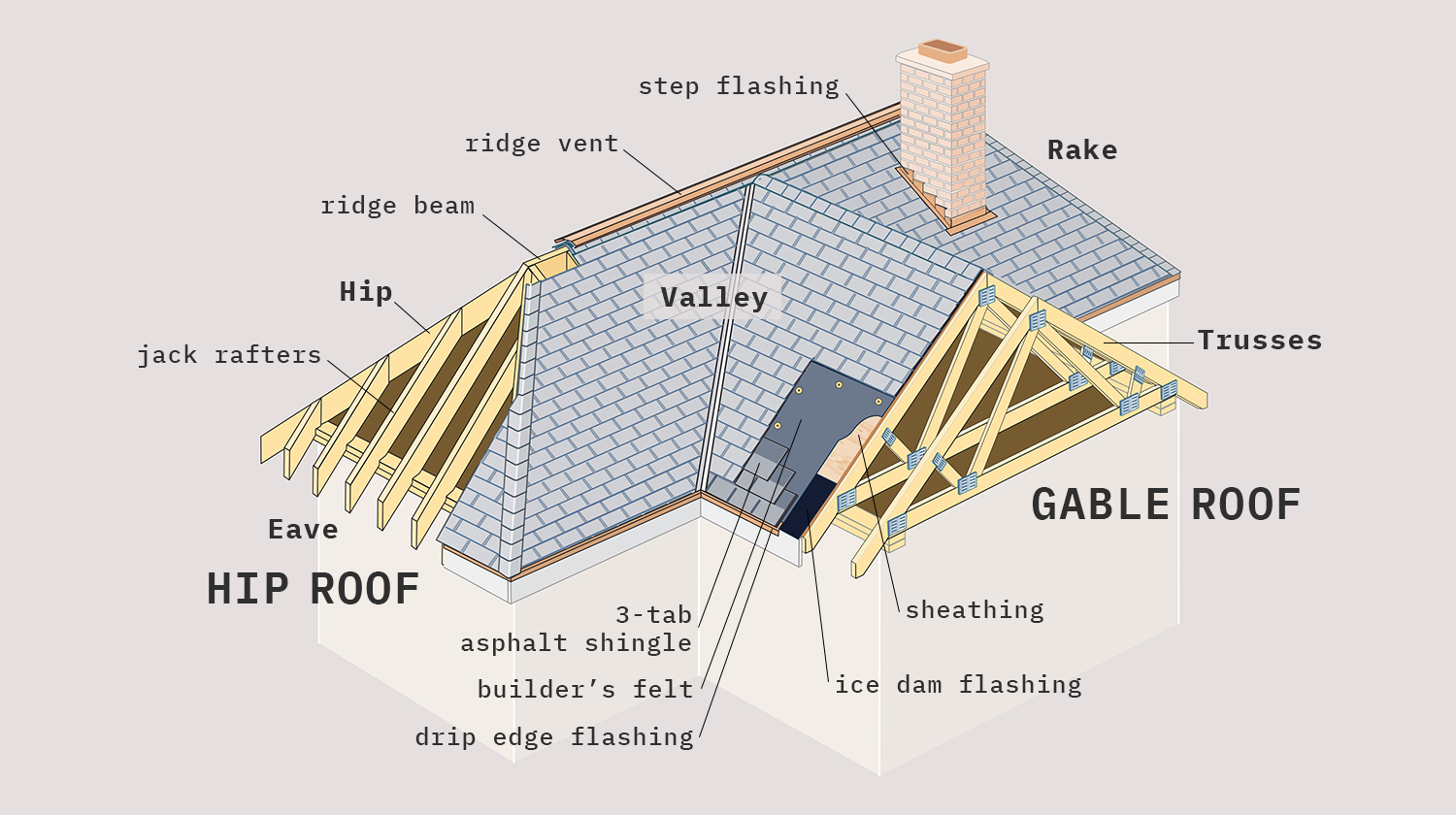

How Much To Build A New Roof

Installing or replacing a new roof across the country will cost you an average of $8, But most homeowners spend between the range of $5, to $11, They. You'll want to budget between $4, and $6, for replacement on a roof that is 1, square feet. This estimate assumes materials like asphalt roof shingles. I'd figure about $$ per square. Might go by a roofing supply shop and see if they can recommend someone. Flat roofing costs in Maryland typically range from $15 to $20 per square foot, with materials and installation included. Materials commonly used for flat roofs. Metal roofs are more durable, ranging from $29, to $46,, while Spanish tile roofs cost between $35, and $75, Lifespan Comparisons. Asphalt shingles. The cost of re-roofing a bungalow is around $15, to $25, For a two-storey house, it can be as much as $30, For a house with a particular structure. The typical range for roof replacement costs is between $ and $, but it can be as low as $ or as high as $ Learn more about the costs. Normal range: $14, - $31, Installing a roof over your patio costs around $21, in most cases, and most homeowners pay between $14, and $31, Tile roofing · Concrete tiles cost between $ and $ per square foot and are designed to look like clay tiles, but are much easier to install. · Clay tiles. Installing or replacing a new roof across the country will cost you an average of $8, But most homeowners spend between the range of $5, to $11, They. You'll want to budget between $4, and $6, for replacement on a roof that is 1, square feet. This estimate assumes materials like asphalt roof shingles. I'd figure about $$ per square. Might go by a roofing supply shop and see if they can recommend someone. Flat roofing costs in Maryland typically range from $15 to $20 per square foot, with materials and installation included. Materials commonly used for flat roofs. Metal roofs are more durable, ranging from $29, to $46,, while Spanish tile roofs cost between $35, and $75, Lifespan Comparisons. Asphalt shingles. The cost of re-roofing a bungalow is around $15, to $25, For a two-storey house, it can be as much as $30, For a house with a particular structure. The typical range for roof replacement costs is between $ and $, but it can be as low as $ or as high as $ Learn more about the costs. Normal range: $14, - $31, Installing a roof over your patio costs around $21, in most cases, and most homeowners pay between $14, and $31, Tile roofing · Concrete tiles cost between $ and $ per square foot and are designed to look like clay tiles, but are much easier to install. · Clay tiles.

Based on our calculations, it costs an average of $31, to $55, to raise a roof. However, some homeowners can pay up to $90, Your price will be on the. That said, slate roofs are heavy, difficult to maintain, and expensive to install. They also vary widely. They typically cost anywhere from $ – $ per. How much does roof replacement cost? The national average to install or replace a roof is $9, - $10, The total cost varies depending on the size. Based on our calculations, it costs an average of $31, to $55, to raise a roof. However, some homeowners can pay up to $90, Your price will be on the. If there's no chimneys, or skylights then you're looking at about $, give or take. All that matters is the type of materials. Roof replacement costs in Baton Rouge range from $ to $, averaging $$ per square ( sq ft). Asphalt replacement averages $ Roof Size Impacts the Cost of New Roof Installation · 10 square roof: $6, to $8, · 15 square roof: $9, to $12, · 20 square roof: $12, to $17, · Flat roofing costs in Maryland typically range from $15 to $20 per square foot, with materials and installation included. Materials commonly used for flat roofs. Average roof costs change from state to state across the US, the national average for a new roof is between $8, and $15, However, the roof replacement. A commercial building needs a roof that covers a lot of square footage Many contractors may claim to be experienced for a roof replacement, however. New Roof Framing Costs ; Materials: lumber, joists, hardware, etc. $4-$5 per kirschen-instrument.ru 1,, $6,$7, ; Labor Cost, $$75 per hour, 40, $1,$3, Asphalt shingle roofs cost between $5, and $20,, with an average cost of about $9, Asphalt shingles are lightweight, economical, easy to install, and. The average cost of a new roof in Pennsylvania can range from $6, to $24,, depending on factors such as the size of the roof, type of roofing material. Roof Replacement Cost by Material ; Asphalt Shingles, $8, - $14, ; Designer Asphalt Shingles, $12, - $25, ; Metal, $22, - $44, ; Cedar Shake or. How much does a new roof cost? · What is the average cost of a roof replacement? · In , the average roof replacement cost for an asphalt shingle roof was. In August the cost to Install a Asphalt Shingle Roof starts at $ - $ per square foot*. Use our Cost Calculator for cost estimate examples. Roof Replacement Cost by Material ; Asphalt Shingles, $8, - $14, ; Designer Asphalt Shingles, $12, - $25, ; Metal, $22, - $44, ; Cedar Shake or. The average cost to install or replace a residential flat roof is $5, to $18, Many factors determine where your roof's price falls within that range. Our. The cost to replace a roof on a house can vary widely, and budgeting for a new roof can seem daunting. Fortunately, we have all the information you need to set. Standing seam metal roofing costs between $ and $ per square foot installed. If an average residential roof size is somewhere between 2, to 3, sq.

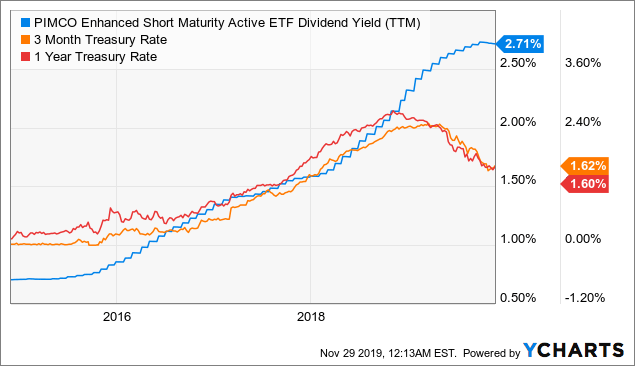

Pimco Mint Review

MINT. NYSE Arca. Before you invest, you may want to review the Fund's prospectus, which contains more information about the Fund and its risks. You can find. If you wish to purchase Institutional and Administrative shares directly, without the help of a financial advisor, you must review a prospectus, complete an. One of the first active bond ETF managers with the launch of MINT in Actively Sourcing Alpha with an Eye on Risk. Experience across the diverse bond. Review of Q1: New normal? Published. April 18, In PIMCO Enhanced Short Maturity ETF (MINT, +$ billion), Alpha Architect Month Box ETF (BOXX. MINT | A complete PIMCO Enhanced Short Maturity Active ETF exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF. For information about any of the underlying funds included in the Model Portfolio, including the fees, expenses and fund specific risks please review the fund. But, it's PIMCO, it may use derivatives and it has lost money in the past. With a maximum drawdown of - % over 10 months, in 9/21 to June PIMCO ETF TRUST ENHANCED SHORT MATURITY ACTIVE ETF USD. PIMCO ETF TRUST ENHANCED SHORT MATURITY ACTIVE ETF USD. kirschen-instrument.ru:MINT. The PIMCO Enhanced Short Maturity Active Exchange-Traded Fund (MINT) is an exchange-traded fund that mostly invests in investment grade fixed income. MINT. NYSE Arca. Before you invest, you may want to review the Fund's prospectus, which contains more information about the Fund and its risks. You can find. If you wish to purchase Institutional and Administrative shares directly, without the help of a financial advisor, you must review a prospectus, complete an. One of the first active bond ETF managers with the launch of MINT in Actively Sourcing Alpha with an Eye on Risk. Experience across the diverse bond. Review of Q1: New normal? Published. April 18, In PIMCO Enhanced Short Maturity ETF (MINT, +$ billion), Alpha Architect Month Box ETF (BOXX. MINT | A complete PIMCO Enhanced Short Maturity Active ETF exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF. For information about any of the underlying funds included in the Model Portfolio, including the fees, expenses and fund specific risks please review the fund. But, it's PIMCO, it may use derivatives and it has lost money in the past. With a maximum drawdown of - % over 10 months, in 9/21 to June PIMCO ETF TRUST ENHANCED SHORT MATURITY ACTIVE ETF USD. PIMCO ETF TRUST ENHANCED SHORT MATURITY ACTIVE ETF USD. kirschen-instrument.ru:MINT. The PIMCO Enhanced Short Maturity Active Exchange-Traded Fund (MINT) is an exchange-traded fund that mostly invests in investment grade fixed income.

Reviews and deals · Audio · Computing · Gaming · Health · Home · Phones · Science · TVs MINT PIMCO Enhanced Short Maturity Active Exchange-Traded Fund. No research was found for MINT but you can find our latest research below Banking sector review - Why the banks aren't banks anymore. The banking sector. either clones of existing mutual fund strategies (MINT for PIMCO; or TOTL, Doubleline's sub-advised total return strategy packaged as a SPDR ETF) or unique. MINT, PIMCO Enhanced Short Maturity Active ET %. --, +%. --, LETRA Carefully review an investment product's prospectus or disclosure brochure. Pimco ETF Trust - Pimco Enhanced Short Maturity Active Exchange-Traded Fund (NYSEMKT: MINT). $ (%). $ Price as of July 26, , p.m. ET. kirschen-instrument.ruyed third-party logos, brands, or PIMCO Enhanced Short Maturity Active Exchange-Traded Fund Declares Monthly Distribution of $ MINT. NYSE Arca. PIMCO Government Limited Maturity Active Exchange-Traded You may review and copy information about the Trust, including its SAI, at. PIMCO Enhanced Short Maturity Active Exchange-Traded Fund (MINT) · Volume: , · Bid/Ask: / · Day's Range: - MINT · PIMCO US SHORT MATURITY UCITS USD IN, USD. %, ETFs review the Company Information and both sets of information are provided for. PIMCO ETFs Plc US Dollar Short Maturity UCITS ETF (MINT) ; Open · $ ; Trade high · $ ; Year high · $ ; Market Listing · London ; Previous close · $ One of the first active bond ETF managers with the launch of MINT in Institutional Investor I'm an institutional investor looking to review investment. With PIMCO, you're paying for immense research capability. They are head and shoulders above everyone in that capacity for fixed income. They. Explore the latest news, in-depth analysis, performance evaluation, and Q&A for PIMCO Enhanced Short Maturity Active Exchange-Traded Fund (MINT). Reviews and deals · Audio · Computing · Gaming · Health · Home · Phones · Science · TVs MINT PIMCO Enhanced Short Maturity Active Exchange-Traded Fund. Institutional Investor I'm an institutional investor looking to review investment strategies, timely insights and connect with my PIMCO relationship management. It takes a broad-based approach to investing in income-generating bonds. The fund aims to achieve this by employing PIMCO's best income-generating ideas across. Pimco Enhanced Short Maturity Active Exchange-traded Fund (MINT) The pivot points are available 24/7 to our members. Please register or login, goto the My. You can buy Park my Cash (PIMCO Enhanced Short Maturity Active Exchange-Traded Fund) (MINT) ETF and many other stocks or ETFs on Stash review by Stash. MINT - PIMCO Enhanced Short Maturity Active ETF - Stock screener for review of ratings of Minor International Public Company Limited. (Moody's).

2 3 4 5 6