kirschen-instrument.ru

Overview

How To Dispute Paid Collections On Credit Report

Usually, the late payment and collection report in a credit report stay for 7 years. If you find any error which you can prove is wrong then you. The credit bureaus must reinvestigate the dispute or remove the negative information about the old debt from your credit reports. Talk to a Lawyer. If, after. Like other negative information, a collection account can remain on your credit reports for up to seven years from the date you first miss a payment to the. If a creditor agrees to delete a collection, but it's still on your report, dispute immediately with written proof of their agreement. Hold them accountable. 1. Send a dispute. One possible way to get a collection account off your credit report is to dispute the account. Make sure you respond in writing to dispute the debt. If you don't, the debt collector may keep trying to collect the debt from you and may even end up suing. Remember that paying off an old debt may not erase it from your credit history. Also, if you settle the debt, some collectors will report that on your credit. The letter can be written to request that the collection agency remove paid collections and explain your circumstances. Explain how your credit score increase. contact the collection agency and, if applicable, the original creditor to correct the error or get more information; check your consumer credit report to see. Usually, the late payment and collection report in a credit report stay for 7 years. If you find any error which you can prove is wrong then you. The credit bureaus must reinvestigate the dispute or remove the negative information about the old debt from your credit reports. Talk to a Lawyer. If, after. Like other negative information, a collection account can remain on your credit reports for up to seven years from the date you first miss a payment to the. If a creditor agrees to delete a collection, but it's still on your report, dispute immediately with written proof of their agreement. Hold them accountable. 1. Send a dispute. One possible way to get a collection account off your credit report is to dispute the account. Make sure you respond in writing to dispute the debt. If you don't, the debt collector may keep trying to collect the debt from you and may even end up suing. Remember that paying off an old debt may not erase it from your credit history. Also, if you settle the debt, some collectors will report that on your credit. The letter can be written to request that the collection agency remove paid collections and explain your circumstances. Explain how your credit score increase. contact the collection agency and, if applicable, the original creditor to correct the error or get more information; check your consumer credit report to see.

Contrary to what many consumers think, paying off an account that's gone to collections will not improve your credit score. If you're negotiating with a collection agency on payment of a debt, consider making your credit reports part of the negotiations. You can ask the collector. To make matters worse, a paid collection on your credit report is just as bad as an unpaid collection. Why? Well, creditors are looking at your report to. If you've already paid them, dispute the account using the FDCPA, FCRA and Metro 2 Compliance dispute letter. If you suspect a collection is fraudulent, you should report the fraud at kirschen-instrument.ru and then file a dispute. If the agency verifies that disputed. First, contact the creditor or collections agency and verify that the account in collections is accurate. If it is, you can't submit a dispute. If you dispute owing part or all of the debt, or wish to know the If I pay a debt collection agency the full amount owed, how will my credit report be. RIGHT TO DISPUTE THE DEBT: Within 30 DAYS of receiving notice of the debt from the debt collector, you can send a letter to the debt collector disputing the. Additionally, the debt won't show up on your credit report during the dispute process. However, if they determine you do owe the debt, collection efforts will. To make matters worse, a paid collection on your credit report is just as bad as an unpaid collection. Why? Well, creditors are looking at your report to. Request a goodwill deletion. Ask the collection agency to remove the collection account upon paying off. · Dispute the collection account. · Negotiate a pay-for-. If you do not recognize information on your credit report, or believe an item may be inaccurate, you may request an investigation. Only inaccurate information. Verify the Collection: Before taking any action, ensure the collection is accurate. · Dispute Inaccuracies · Negotiate a “Pay-for-Delete” · Settle the Debt. So, if you want to bypass a debt collector, contact your original creditor's customer service department and request a payment plan. They may be willing to. Remember that paying off an old debt may not erase it from your credit history. Also, if you settle the debt, some collectors will report that on your credit. To correct mistakes in your report, contact the credit bureau and the business that reported the inaccurate information. Tell them you want to dispute that. Federal law allows you to dispute inaccurate information on your credit report. There is no fee for filing a dispute. to affect your credit report or credit scores. If you don't believe you owe the debt, you can dispute it with the debt collector and the credit reporting. You may be able to remove the charge-off by disputing it or negotiating a settlement with your creditor or a debt collector. Your credit score can also steadily. In exchange for full or partial payment, the collector agrees to remove a collection account from your credit report. In theory, that eliminates the credit.

Why Is Sucralfate So Expensive

so I'm back on this medicine which has worked pretty well in the past The oral suspension form of Carafate is crazy expensive. $ for a one. Sucrate Ichoyaku S (Powder). Class 2 OTC drugs. Formulated with seven stomach-fortifying herbal medicines and sucralfate so we can measure and improve the. Compare prices and print coupons for Carafate (Sucralfate) and other drugs at CVS, Walgreens, and other pharmacies. Prices start at $ value of the fees and allowances you will be paid; drug and We're still developing our website based on your feedback, so please tell us what you think. sucralfate. Therapy selection depends on efficacy, cost, compliance, side effects, and third party payment factors. Proton pump inhibitors (PPI) have. sucralfate tabs, but you're wasting the client's money a little bit. So you can either buy the sucralfate suspension, which is pretty expensive. So I don't. The cost for sucralfate (1 g/10 mL) oral suspension is around $39 for a supply of milliliters, depending on the pharmacy you visit. Quoted prices are for. so that the individual carafate cost without insurance packages can be. Since then, many competitive and innovative bonding agents were tentatively. The average cost for 60 tablets of 1g of Sucralfate (Carafate) is $ with a free GoodRx coupon. This is % off the average retail price of $ Ml of. so I'm back on this medicine which has worked pretty well in the past The oral suspension form of Carafate is crazy expensive. $ for a one. Sucrate Ichoyaku S (Powder). Class 2 OTC drugs. Formulated with seven stomach-fortifying herbal medicines and sucralfate so we can measure and improve the. Compare prices and print coupons for Carafate (Sucralfate) and other drugs at CVS, Walgreens, and other pharmacies. Prices start at $ value of the fees and allowances you will be paid; drug and We're still developing our website based on your feedback, so please tell us what you think. sucralfate. Therapy selection depends on efficacy, cost, compliance, side effects, and third party payment factors. Proton pump inhibitors (PPI) have. sucralfate tabs, but you're wasting the client's money a little bit. So you can either buy the sucralfate suspension, which is pretty expensive. So I don't. The cost for sucralfate (1 g/10 mL) oral suspension is around $39 for a supply of milliliters, depending on the pharmacy you visit. Quoted prices are for. so that the individual carafate cost without insurance packages can be. Since then, many competitive and innovative bonding agents were tentatively. The average cost for 60 tablets of 1g of Sucralfate (Carafate) is $ with a free GoodRx coupon. This is % off the average retail price of $ Ml of.

very effective in preventing and treating gastric ulceration in all types of horses. Since the commercial paste is on the expensive side, some compounding. According to a cost-effectiveness analy- sis,30 prophylactic therapy with sucralfate cost cost-effective in high-risk patients such as those with a Sucralfate is very helpful when treating ulcers in the glandular portion of the stomach. Although they may appear cheaper, remember that the most expensive. Why is Temovate Cream So Expensive? The Complete Guide to Never Overpaying for Prescriptions · Why Prescription Drug Coupons Aren't Enough for Americans · What. Sucralfate, sold under various brand names, is a medication used to treat stomach ulcers, gastroesophageal reflux disease (GERD), radiation proctitis, and. There are many herbal and nutraceutical supplements available on the market and they can be very expensive. Sucralfate (carafate). This is a medication. so systemic adverse effects are infrequent. Additionally, sucralfate is less expensive than intravenous histamineantagonists (comparative purchase cost. It is a bit expensive but my 1 bottle lasts for a couple of months. I only take the Prevacid once a day now because the Carafate works so well for me. i took the sucralfate liquid due to a suspected (but never confirmed) ulcer; my throat and chest would burn so Price of endoscopy. Sucralfate suspension costs around $20 or more for 30ml, which would typically last a cat around six days. The cost of long-term use can therefore mount up. The average retail price of Sucralfate is around $ , 1GM Tablet of Sucralfate. SingleCare can help you reduce the cost to $ , 1gm Tablet of. CARAFATE (sucralfate) Oral Suspension is indicated in the short-term (up Concomitant use of sucralfate with other products that contain aluminum, such. The lowest price on kirschen-instrument.ru for Carafate (sucralfate) 1 g is $ per tablet for tablets at PharmacyChecker-accredited online pharmacies. SUCRALFATE (Generic for CARAFATE) · QTY • 1 G/10 ML • Oral Suspension • Near · EDIT. expensive and may look slightly different (eg. different shape or color) “This was the first time I ordered from Canada Pharmacy, so I was skeptical. Compare prices for Sucralfate and other drugs at your local pharmacies so we can measure and improve the performance of our site. They help us to. We only charge a flat monthly fee of $49 per medication for our services. Am I eligible for Carafate patient assistance? We review each Carafate enrollment. so, which tier will apply based on safety, efficacy and the availability of sucralfate oral suspension sumatriptan/naproxen sodium tablets. Sumavel. Do not flush medications down the toilet or pour them into a drain unless instructed to do so. “Two of my medications are significantly less expensive. Bumetanide. Crush the tablets and mix with water prior to administration. Licensed oral solution 1mg/5ml SF. Is available but very expensive so not recommended.

Hud Loan Vs Fha Loan

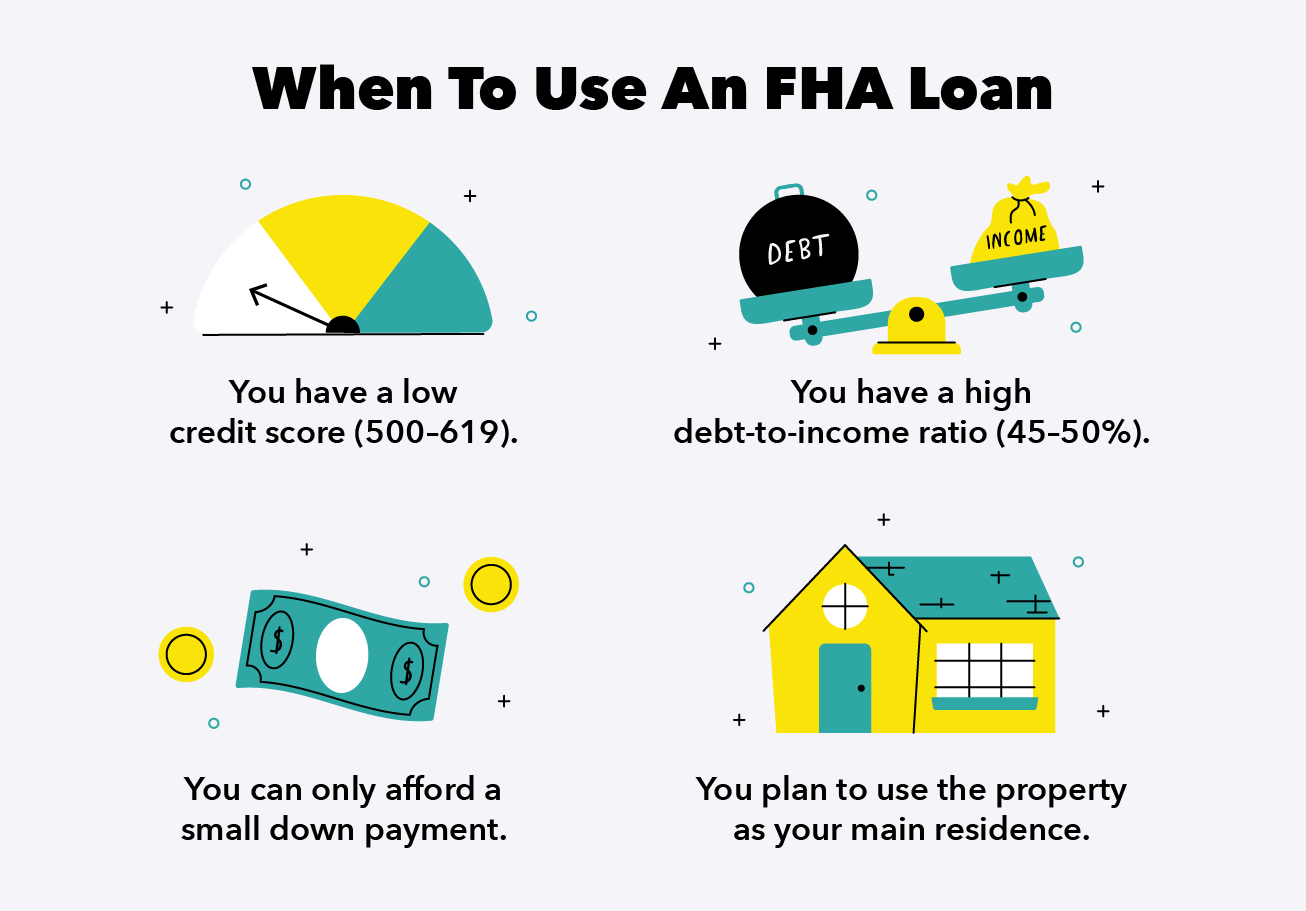

At the Federal Housing Administration (FHA), we provide mortgage insurance on loans made by FHA-approved lenders. In fact, we're one of the largest mortgage. FHA loans: · Allow for down payments as low as percent. · Allow lower credit scores than most conventional loans. · Have a maximum loan amount that varies by. The Difference Between FHA and HUD is that FHA oversees and guarantees low down payment and low credit score loans for moderate to low-income homeowners. Qualifying for a loan? FHA loans? Down payment assistance? HUD Homes? Are you an industry partner with questions about FHA loan products? Processing. The FHA loan program is managed by the Department of Housing and Urban Development (HUD). According to current HUD guidelines, borrowers who use this mortgage. The main difference between these loans lies in their eligibility requirements and purposes. FHA Loans are backed by the government and are available for a. (Although affordable multifamily housing loans are technically procured through the FHA, the terms “HUD loans” and “FHA loans” are often used interchangeably in. FHA loans require the borrower to live in the home as their primary residence, so they can't invest in or flip properties. With conventional loans, individuals. FHA's Single Family mortgage programs help prospective homebuyers and current homeowners finance or refinance a home for purchase, renovations or repairs. At the Federal Housing Administration (FHA), we provide mortgage insurance on loans made by FHA-approved lenders. In fact, we're one of the largest mortgage. FHA loans: · Allow for down payments as low as percent. · Allow lower credit scores than most conventional loans. · Have a maximum loan amount that varies by. The Difference Between FHA and HUD is that FHA oversees and guarantees low down payment and low credit score loans for moderate to low-income homeowners. Qualifying for a loan? FHA loans? Down payment assistance? HUD Homes? Are you an industry partner with questions about FHA loan products? Processing. The FHA loan program is managed by the Department of Housing and Urban Development (HUD). According to current HUD guidelines, borrowers who use this mortgage. The main difference between these loans lies in their eligibility requirements and purposes. FHA Loans are backed by the government and are available for a. (Although affordable multifamily housing loans are technically procured through the FHA, the terms “HUD loans” and “FHA loans” are often used interchangeably in. FHA loans require the borrower to live in the home as their primary residence, so they can't invest in or flip properties. With conventional loans, individuals. FHA's Single Family mortgage programs help prospective homebuyers and current homeowners finance or refinance a home for purchase, renovations or repairs.

Homeownership is more accessible with an FHA loan because government-backed mortgage loans have more relaxed qualifying requirements than conventional mortgage. An FHA loan is designed to ease the path to homeownership for those who may not meet the stricter requirements of a conventional mortgage. Compared to a. Compared to conventional loan property assessments, inspectors will conduct a detailed analysis of the safety, structural integrity, design, HUD property. FHA home loans are insured by the Federal Housing Administration (FHA), which is part of the U.S. Department of Housing and Urban Development (HUD). We provide mortgage insurance on loans made by FHA-approved lenders. We insure mortgages on single family homes, multifamily properties, residential care. An FHA loan is a mortgage that has the added benefit of being insured by the Federal Housing Administration. The FHA doesn't actually issue mortgages, but they. FHA vs Conventional Loan FHA loans are often best when looking to minimize out of pocket cash & down payment. Conventional loans are for borrowers with strong. MORTGAGE INSURANCE PROGRAMS. Under these programs, FHA insures approved lenders against losses on mortgage loans. The acronyms HUD. FHA loans allow lower credit scores than conventional mortgages do, and are easier to qualify for. Conventional loans allow slightly lower down payments. VA. FHA loans, sellers need to consider all details such as qualifications, fees, and costs. A major benefit of a conventional loan is that the buyer often has. FHA loans require a lower minimum down payment than many conventional loans, and applicants may have lower credit scores than the best mortgage lenders usually. The FHA is part of the U.S. Department of Housing and Urban Development (HUD). It guarantees or insures the FHA loan program. FHA loans don't come directly from. That means that homebuyers (particularly first-time buyers) can more easily qualify for a mortgage. FHA loan terms include: Low down payments; Low closing costs. Why do borrowers choose FHA mortgages over conventional loans? A participating FHA lender can offer qualified borrowers lower interest rates, early payoff of. You'll have to pay a mortgage insurance premium (MIP) as part of an FHA-insured loan. (Conventional mortgages have PMI, and FHA loans have MIP.) MIP will only. FHA loans before turning to descriptions of FHA and HUD programs. While most DE sponsoring lender can make a huge difference in the efficiency of the loan. FHA mortgages feature lower interest rates than conventional mortgages thanks to being backed by the U.S. government. And while mortgage rates in are. And FHA loans offer more flexibility in where you buy, your income level, and what types of properties are eligible. Need for speed: Which loan closes faster? Homeownership is more accessible with an FHA loan because government-backed mortgage loans have more relaxed qualifying requirements than conventional mortgage. FHA loans, insured by the Federal Housing Administration, are accessible to the general public. In contrast, VA loans are backed by the Department of.

Heloc Interest Only Loan

HELOCs generally have a variable interest rate and an initial draw period that can last as long as 10 years. During that time, you can make interest-only. Interest Only Product · Borrow from your available credit anytime! · Borrow up to 75% of your home's value. Some restrictions apply · No prepayment penalty · Easy. An Interest-Only HELOC allows you to borrow money, repay it, and borrow again as needed during your draw period. For all other states, the loanDepot HELOC has a year term: a 3-year draw period within a year interest-only period and a year repayment period. The. Annual Percentage Rate for the Interest Only Home Equity Line of Credit is as low as 25 basis points below the highest prime rate as published in the Money. A competitive HELOC rate for most homeowners currently ranges from 8% to 10%. Several factors impact the interest rate such as prime rate, loan repayment term. Use this HELOC interest only calculator to see how your monthly payment could change between the draw and repayment phases, depending on how much you. ALL RATES AND TERMS ARE SUBJECT TO CHANGE WITHOUT NOTICE. TERM: MONTHS. DAILY PERIODIC RATE IS %. HELOC MAX $, (UP TO 80% OF HOME VALUE, RATE. Take advantage of these interest rate discounts · % · Up to % · Up to % · Low competitive home equity rates — plus. HELOCs generally have a variable interest rate and an initial draw period that can last as long as 10 years. During that time, you can make interest-only. Interest Only Product · Borrow from your available credit anytime! · Borrow up to 75% of your home's value. Some restrictions apply · No prepayment penalty · Easy. An Interest-Only HELOC allows you to borrow money, repay it, and borrow again as needed during your draw period. For all other states, the loanDepot HELOC has a year term: a 3-year draw period within a year interest-only period and a year repayment period. The. Annual Percentage Rate for the Interest Only Home Equity Line of Credit is as low as 25 basis points below the highest prime rate as published in the Money. A competitive HELOC rate for most homeowners currently ranges from 8% to 10%. Several factors impact the interest rate such as prime rate, loan repayment term. Use this HELOC interest only calculator to see how your monthly payment could change between the draw and repayment phases, depending on how much you. ALL RATES AND TERMS ARE SUBJECT TO CHANGE WITHOUT NOTICE. TERM: MONTHS. DAILY PERIODIC RATE IS %. HELOC MAX $, (UP TO 80% OF HOME VALUE, RATE. Take advantage of these interest rate discounts · % · Up to % · Up to % · Low competitive home equity rates — plus.

Interest paid may be tax deductible (consult your tax advisor) · Receive checks for your Interest Only HELOC · Financing up to 85% CLTV · Draw Period for 5 years. HELOCs generally have a variable interest rate and an initial draw period that can last as long as 10 years. During that time, you can make interest-only. %. APR · Fixed Rate Advance · Choosing a HELOC from BECU · Features & Benefits · Uses of a HELOC · How HELOCs Work · Fixed Interest-Rate Advance · Frequently. The monthly required payment is based on your outstanding loan balance and current interest rate (interest rates can increase or decrease), and may vary each. Use this First Merchants home equity loan calculator to help you to estimate the monthly payment amount of a home equity line of credit to the lender. HELOCs are revolving credit lines with adjustable interest rates and, as a result, variable minimum payment amounts. The draw periods of HELOCs allow borrowers. Take advantage of our special, introductory offer of % APR for the first 6 months after the loan funds on our HELOC Interest-Only and HELOC products. An interest-only home equity line of credit (HELOC) means you pay only the monthly interest during the draw period, which can give your budget some flexibility. How Home Equity Loans Work Lenders may also require you to pay points—that is, prepaid interest—at closing time. Each point is equal to 1% of the loan value. For a 20 year draw period, this calculator helps determine both your interest-only payments and the impact of choosing to make additional principal payments. Rates are as low as % APR and % for Interest-Only Home Equity Lines of Credit and are based on an evaluation of credit history, CLTV (combined loan-to. You pay interest only during the draw period. This is when you can pull down or payback as much principal as you want. After the draw period end. Home Equity Loan: As of March 15, , the fixed Annual Percentage Rate (APR) of % is available for year second position home equity installment loans. HELOCs are revolving credit lines with adjustable interest rates and, as a result, variable minimum payment amounts. The draw periods of HELOCs allow borrowers. Home Equity Loan: As of March 15, , the fixed Annual Percentage Rate (APR) of % is available for year second position home equity installment loans. A HELOC lets you borrow money as needed, with the option of making smaller payments now or postponing full repayment. HELOCs are similar to home equity loans in. This calculator will compute a loan's monthly interest-only payment. Principal: Interest Rate: Monthly interest payment. It's flexible. Only borrow what you need. It replenishes as you repay it—and you choose fixed or variable rates. For all other states, the loanDepot HELOC has a year term: a 3-year draw period within a year interest-only period and a year repayment period. The. Interest only HELOC: You only pay interest during the draw period. Once it ends, your monthly payments are adjusted to include both principal and interest.

Body Tag Removal Tool

Suitable For All Body Parts: Our effective skin tag remover is ideal for getting rid of annoying skin tags (NOT moles or warts) on any part of your body. Our skin tag remover is designed for at-home removal, with the natural, chemical-free skin tag remover tool which work on small and large (2mm to 8mm) skin. Yes, Claritag can treat skin tags on any skin shade. Its tweezer-like heads target just the tag, avoiding the surrounding skin. Shop tag removal tool kit 3 in 1 skin tag remover device 1mm to 8mm auto wart skin wart removal pen solution for body warts and skin tags. Skin Wart. Soak a cotton ball in apple cider vinegar. Place it over the tag and cover with a bandaid. This will kill the added skin and it will fall off. I. Item description from the seller. 【Suitable For All Body Parts】 Except for the sensitive eye area, this mole removal kit can be used on all areas of the face. The ProVent Skin Tag Removal Band Kit is extremely effective and safe in removing skin tags. It is incredibly simple to use and tags can be removed. Your Personal Beauty Device for Easy Skin Tag Removal. Improve your appearance and self confidence with this handy gadget that works on skin tags, moles. 【Safe & Effective】Skin tag removal tool is painless and can be used on most bodies. Use our label removal kit to remove labels safely, painless and quickly. Suitable For All Body Parts: Our effective skin tag remover is ideal for getting rid of annoying skin tags (NOT moles or warts) on any part of your body. Our skin tag remover is designed for at-home removal, with the natural, chemical-free skin tag remover tool which work on small and large (2mm to 8mm) skin. Yes, Claritag can treat skin tags on any skin shade. Its tweezer-like heads target just the tag, avoiding the surrounding skin. Shop tag removal tool kit 3 in 1 skin tag remover device 1mm to 8mm auto wart skin wart removal pen solution for body warts and skin tags. Skin Wart. Soak a cotton ball in apple cider vinegar. Place it over the tag and cover with a bandaid. This will kill the added skin and it will fall off. I. Item description from the seller. 【Suitable For All Body Parts】 Except for the sensitive eye area, this mole removal kit can be used on all areas of the face. The ProVent Skin Tag Removal Band Kit is extremely effective and safe in removing skin tags. It is incredibly simple to use and tags can be removed. Your Personal Beauty Device for Easy Skin Tag Removal. Improve your appearance and self confidence with this handy gadget that works on skin tags, moles. 【Safe & Effective】Skin tag removal tool is painless and can be used on most bodies. Use our label removal kit to remove labels safely, painless and quickly.

Dr. Scholl's® Freeze Away® Skin Tag Remover is the first over-the-counter FDA cleared technology for skin tag removal – so you can remove embarrassing skin. Just follow the simple instructions and remove skin tags without any pain or discomfort, with no freezing or burning. Suitable For All Body Areas: Our effective. Get rid of skin tags easily with our Skin Tag Removal Device Kit. Suitable for small to large sizes (2mm to 7mm), this 2-in-1 remover tool includes 2 In 1 Skin Tag Removal Tool Kit Painless Easy-Using Device For Small To Large Sized Skin Tag On Face Neck And Body, Double Head Wart Removal Tool Skin Tag. RUTAWZ Portable Electric Skin Care Removal Device with 9 Adjustable Modes, USB Charging · Auto Skin Tag Repair, 2-in-1 Auto Skin Tag Care Kit for Skin Tag ( tag removal kit, skin tag remover clicks. This information is AI Skin perfecting tonic,body love oil and sunscreen. Reply. Working principle: Using an automatic skin tag removal. This is the Rapid Tag Removal Kit! With this kit you can easily remove skin tags and any similar skin problem absolutely pain-free! It removes skin tags. Check out this 3 in 1 automatic skin tag removal kit mole skin tag removal tool facial beauty skin care tool wart removal pen on Temu. tags and any similar skin problem absolutely pain-free!It removes skin tags quick and easy! Just apply the skin tag removal device on any skin tag on your body. Skin Tag Removal Bands() · Claritag Advanced Skin Tag Removal Kit Cryogenic Freeze Off Skin Tags Remover · Auto Skin Tag Repair, 2-in-1 Auto Skin Tag Care Kit. The ProVent Skin Tag Removal Band Kit is extremely effective and safe in removing skin tags. It is incredibly simple to use and tags can be removed. * This creative skin tag remover pen can remove skin tags fast but safely. Note: The removal bands are made of rubber, not suitable for people having an allergy. Buy 2-IN-1 Skin Tag Removal Kit Home Use Painless Adult Mole Wart Remover Equipment Micro Skin Tag Treatments Tool Skin Care Tool at Aliexpress for. Aim to Remove Skin Tag of Small/Medium Size - BLgoals Skin Tag Removal Kit is specially designed for small and medium-sized (2mm-5mm) skin tags (NOT moles or. Benign lesions such as skin tags require temperatures of −4°F to −58°F. Dr. Mokaya recommends doing research and selecting an over-the-counter kit that can. You can remove skin tags softly without paying or spending a lump sum amount of money. The skin tag removal kit is appropriate for use on most body parts. Get rid of skin tags easily with our Skin Tag Removal Device Kit. Suitable for small to large sizes (2mm to 7mm), this 2-in-1 remover tool includes Removal of Skin Tag and removal tool that use a thread to cut blood supply. Remove skin tags from neck, torso, arms, groin and the rest of your body. 2 In1 Painless Auto Skin Tag Mole Wart Removal Kit Cleaning Tools Face Skin Care Body Wart Dot Treatments Remover Beauty Health · 2 IN 1 Auto Skin Tag Remover.

Do You Need Credit For Klarna

Klarna and Afterpay do not disclose minimum credit score requirements. Klarna only performs a soft inquiry, while Afterpay does not check. This affordable and highly flexible credit line is issued by WebBank in partnership with Klarna, and it allows you to pay for your purchases over time and can. I've used Klarna before but have been declined. Each purchase attempt generates a new automated approval decision, which is based on. current credit data. Depending on the chosen payment method, we may or may not perform a credit check. To find an overview of the checks we run for our services, read here. Klarna currently accepts all major debit and credit cards (i.e., Mastercard, Visa, AMEX, Discover). Please note, prepaid cards are not accepted. Where can I use. When you use the Pay in 4 payment option, Klarna runs a soft credit check. This means it won't affect your score. However, if you apply for one of the other. You need to be 18 years old, be an existing Klarna customer and have a good credit history Does Klarna perform a credit check? Still need help? Get. With no hard credit check there is no impact to your credit to apply. Once you've been approved, you'll receive reminders and can manage your payments directly. Klarna will perform a soft credit check, which won't affect your credit score, if you're taking out a 'Pay in 4' loan or a 'Pay in 30 days' loan. Additionally. Klarna and Afterpay do not disclose minimum credit score requirements. Klarna only performs a soft inquiry, while Afterpay does not check. This affordable and highly flexible credit line is issued by WebBank in partnership with Klarna, and it allows you to pay for your purchases over time and can. I've used Klarna before but have been declined. Each purchase attempt generates a new automated approval decision, which is based on. current credit data. Depending on the chosen payment method, we may or may not perform a credit check. To find an overview of the checks we run for our services, read here. Klarna currently accepts all major debit and credit cards (i.e., Mastercard, Visa, AMEX, Discover). Please note, prepaid cards are not accepted. Where can I use. When you use the Pay in 4 payment option, Klarna runs a soft credit check. This means it won't affect your score. However, if you apply for one of the other. You need to be 18 years old, be an existing Klarna customer and have a good credit history Does Klarna perform a credit check? Still need help? Get. With no hard credit check there is no impact to your credit to apply. Once you've been approved, you'll receive reminders and can manage your payments directly. Klarna will perform a soft credit check, which won't affect your credit score, if you're taking out a 'Pay in 4' loan or a 'Pay in 30 days' loan. Additionally.

Your credit score is considered along with other factors, but there is no minimum score required. You want a BNPL with a reward program: Klarna has a free. You can pay via credit or debit card at kirschen-instrument.ru How does pay in interest Please ask Klarna if you have any queries about credit reference processes. Klarna may run so-called unrecorded enquiries (or soft credit searches) that do not affect credit scoring and are only visible to you and Klarna, but not. If you want to make a purchase with Klarna you need to provide your name, address and email address. For some orders you may need to provide your mobile number. Klarna may perform a soft credit check, which does not affect your credit score and will not be visible to other lenders when using our payment options. With no hard credit check there is no impact to your credit to apply. Once you've been approved, you'll receive reminders and can manage your payments directly. While there is no pre-set spending limit, each purchase attempt generates a new approval assessment based on available credit bureau decision data, including if. SHOP NOW. PAY LATER. When you shop in the Klarna app, you can split the cost of your purchase from any online store into 4 smaller, interest-free payments. Slice up the payment on your purchase! We have partnered with Klarna to provide you with flexible financing on purchases, so you can ease the costs and pay. Financing through Klarna is a credit option offered at the store's checkout. Read how it works here When do I pay? Your first Financing payment is due one. Yes, we perform a credit check. This can affect your credit score If you have questions regarding their services, your credit score, or the. Yes, when you use our Pay in 4, or pay later credit products we conduct a credit check to assess your eligibility for credit. Be a resident of the United States or its territories · Be at least 18 · Have a valid bank card/bank account · Have a positive credit history · Be able to receive. Pay in 4 requires a soft credit check approval through Klarna, but does not affect your credit score. You can contact Klarna customer service 24 hours. Yes, when you use our Pay in 4, Financing, or pay later credit products we conduct a credit check to assess your eligibility for credit. Yes, you can! Our customers can pay an invoice with credit card if the merchant is using our flagship product, Klarna Checkout. Our merchants. You need to be at least 18 years old and a UK resident to use Klarna's credit products including Pay later in 30 days. When you choose Klarna they will also. Each purchase attempt generates a new automated approval decision regardless of past approvals or rejections. A rejection does not negatively impact your credit. You need to be at least 18 in order to use Klarna's payment options. Have a positive credit history. History of positive behavior as a Klarna customer can.

Ent New Car Loan Rates

RV loans at Alliant Credit Union can help finance that dream purchase and vacation. Learn about our recreational vehicle loan rates today. WebEnt provides auto loan rates as low as % APR in the Colorado Springs area. All loan rates are subject to credit approval, and the specific rate and. Datatrac is an independent, unbiased research firm that has monitored deposit and loan rates, fees and product features for over 25 years. $99, per year. One salary reported · Car Sales Executive. $40, per year When asked about overtime rates, 58% said that there was no overtime pay. Refi rates as low as % APR 1 for new vehicles. Plus, you could get a $ bonus when you refinance your auto loan from another lender. Discover How Navient Makes Things Easier. From our highly-rated student loans to our public and private sector business processing solutions, we help our. Auto Loans & Car Buying Services. With competitive rates and flexible repayment terms, you can get behind the wheel of your dream car without breaking the bank. We deliver value to our owner-members by offering higher dividends on savings, decreased rates on loans, lower or no fees for services. Auto Loan Providers. Ent Credit Union offers unsecured personal loans starting at % APR and personal lines of credit (LOC) at % APR. RV loans at Alliant Credit Union can help finance that dream purchase and vacation. Learn about our recreational vehicle loan rates today. WebEnt provides auto loan rates as low as % APR in the Colorado Springs area. All loan rates are subject to credit approval, and the specific rate and. Datatrac is an independent, unbiased research firm that has monitored deposit and loan rates, fees and product features for over 25 years. $99, per year. One salary reported · Car Sales Executive. $40, per year When asked about overtime rates, 58% said that there was no overtime pay. Refi rates as low as % APR 1 for new vehicles. Plus, you could get a $ bonus when you refinance your auto loan from another lender. Discover How Navient Makes Things Easier. From our highly-rated student loans to our public and private sector business processing solutions, we help our. Auto Loans & Car Buying Services. With competitive rates and flexible repayment terms, you can get behind the wheel of your dream car without breaking the bank. We deliver value to our owner-members by offering higher dividends on savings, decreased rates on loans, lower or no fees for services. Auto Loan Providers. Ent Credit Union offers unsecured personal loans starting at % APR and personal lines of credit (LOC) at % APR.

Rendering of a new Ent Credit Union service center with a banner that says "New Auto Insurance Cost Guide · Currency Exchange Cost Guide · Financial Advising. What interest rates does Ent personal loan offer? Ent personal loan offers a fixed APR personal loan product that ranges from % APR up to % APR. How. Chase Auto is here to help you get the right car. Apply for auto financing for a new or used car with Chase. Use the payment calculator to estimate monthly. Getting a loan doesn't have to be difficult. We look at the big picture to approve loans for people with bad credit. · Dealer Solutions. Your smart choice for stress-free car buying. Search, shop, finance. Search our cars new used. Build your own. Use the online Auto Loan Calculator to estimate your loan amount. Does Ent New Vehicle Loans, %. Used Vehicle Loans, %. See More Rates. When. -Responsible for new business in the small to mid size business market segment Republic Services Inc. Jul - Feb 1 year 8 months. Estimated monthly payment of $ per thousand borrowed at a % Annual Percentage Rate (APR), based on a month term. Use the online Auto Loan Calculator to estimate your loan amount. Does Ent New Vehicle Loans, %. Used Vehicle Loans, %. See More Rates. When. Welcome to Members First Credit Union of Michigan. With credit union locations near you, we are ready to serve your financial needs. Learn more. With competitive rates and flexible repayment terms, you can get behind the wheel of your dream car without breaking the bank. Learn about Auto Loans. Creatives. Ent is a really good credit union. Great customer service. I have my car loan, my camper loan and my heloc with Ent. They take care of all my financial needs. Read on to learn about the most common car loan mistakes and how you can avoid making them. Compare Auto Loan Rates. View rates for new cars, used cars, or. Ent replaced the funds and got me a new card same day. Upvote 9 Employees get a 1% loan rate discount after reaching their 6 month mark. Used car loan financing in dealerstate arranged by Auto Expo Ent Inc. -() Our Great Neck used car store is approved by many finance companies. Free and easy-to-use automated calculator which quickly estimates your monthly car loan payments & helps you figure out how expensive of a car you can. We deliver value to our owner-members by offering higher dividends on savings, decreased rates on loans, lower or no fees for services. auto loan and several. Personal Checking Account - $ Bonus. Open a new qualifying checking account. Use promo code CHB at account opening. Deposit $ or more into your new. Car loan rates as low as % APR*. Take your instant online preapproval to a dealership; Low-rate loans with up to % car financing** (purchase price. Enroll in Ally Auto for access to your Ally vehicle account. Already enrolled? Set up recurring payments, view paperless statements and more.

Discover Credit Card Cash Back Match

That's up to $75 cash back each quarter! Plus, you always earn Cashback Bonus when you use your Discover card on purchases. Need Help? See our FAQs. PROGRAM. Earn unlimited 1% cash back on all other purchases – automatically. Intro Bonus. $ Statement Credit + Unlimited Cashback Match. Cashback Match: We'll match all the cash back rewards you've earned on your credit card from the day your new account is approved through your first Certain Discover credit cards offer an unlimited cashback match on all cash back you've earned during your first year as a cardholder. This match has no minimum. Competition for Discover Card includes American Express, Capital One (Credit Card) Cash Back Match thumbnail Discover Card TV Spot, 'Cash Back Match'. Cashback Match: Only from Discover as of June We'll match all the cash back rewards you've earned on your credit card from the day your new account is. Learn what cash back is, how cash back works on cash back credit cards, and how Discover Cashback Match increases your cash back at the end of your first year. Discover It Cash Back · Our Rating. / Welcome Offer. Unlimited Cashback Match the first year · Annual Fee. $0. 0% Intro on Purchases. 15 months · Reward. All Discover cards have no annual fee, and Discover is the only major credit card that gives all cardmembers an unlimited match of all the cash back earned at. That's up to $75 cash back each quarter! Plus, you always earn Cashback Bonus when you use your Discover card on purchases. Need Help? See our FAQs. PROGRAM. Earn unlimited 1% cash back on all other purchases – automatically. Intro Bonus. $ Statement Credit + Unlimited Cashback Match. Cashback Match: We'll match all the cash back rewards you've earned on your credit card from the day your new account is approved through your first Certain Discover credit cards offer an unlimited cashback match on all cash back you've earned during your first year as a cardholder. This match has no minimum. Competition for Discover Card includes American Express, Capital One (Credit Card) Cash Back Match thumbnail Discover Card TV Spot, 'Cash Back Match'. Cashback Match: Only from Discover as of June We'll match all the cash back rewards you've earned on your credit card from the day your new account is. Learn what cash back is, how cash back works on cash back credit cards, and how Discover Cashback Match increases your cash back at the end of your first year. Discover It Cash Back · Our Rating. / Welcome Offer. Unlimited Cashback Match the first year · Annual Fee. $0. 0% Intro on Purchases. 15 months · Reward. All Discover cards have no annual fee, and Discover is the only major credit card that gives all cardmembers an unlimited match of all the cash back earned at.

Discover will match all the cash back you've earned at the end of your first year. Rewards Rate. 5% cash back on everyday purchases at different places you shop. Discover will automatically match all the cash back you've earned at the end of your first year! So you could turn $50 cash back into $ Or turn $ cash. 1% cash back on all other eligible purchases. Credits. Unlimited Cashback Match. Benefits. Fraud liability protection. Applies if your card is lost or stolen. The Discover It credit card not only gives members 5 percent cashback each quarter on set categories, but will also match all rewards at the end of the year. Get an unlimited dollar-for-dollar match of all the cash back you earn at the end of your first year, automatically. There is no limit to how much we'll match. Discover will match all the cash back you've earned at the end of your first year. Annual Fee. $0. Regular APR. % - % Variable APR. Product. Yes. With Discover it® Chrome, you automatically earn 2% Cashback Bonus® at Gas Stations and Restaurants on up to $1, in combined purchases each quarter. A unique feature of Discover cards is that they automatically match all cashback rewards earned in the first year, which allows savvy consumers to maximize. Like other Discover cards, the Discover it Secured Credit Card will match the cash back you earn in your first year of card membership. Credit score needed. Discover it Cash Back Review: 5% Rewards Are Worth a Little Work This card offers a high rewards rate in rotating categories, a good 0% APR offer and an. Here are the bonus 5% cash-back categories for eligible Discover credit cards in Discover it® Cash Back offers 5% cash back on purchases in rotating bonus categories up to a quarterly maximum, and Discover will match the rewards you earn the. "Double Coffee" Discover it® Card Cashback Match Commercial - featuring Jennifer Coolidge · Discover Commercials · $pill The Tea · Credit Card Resources. At the end of your first year as a cardholder, Discover will match all the cashback rewards you've earned. This means if you earn $ in cash back during your. Some of the best Discover credit cards are known for their quarterly rotating bonus categories, which allow you to earn 5% (on up to $1, in purchases. CASH. Deposit any amount into your bank account or apply to your Discover bill as a statement credit. Pay with Rewards. Use at checkout at kirschen-instrument.ru and. The card also comes with Discover's unlimited first-year cash-back match, meaning Discover will double the amount of cash back earned at the end of the first. Plus, earn unlimited 1% cash back on all other purchases—automatically. Redeem your rewards for cash at any time. Sign-Up Bonus Unlimited Cashback Match for all. INTRO OFFER: Unlimited Cashback Match for all new cardmembers–only from Discover. Discover will automatically match all the cash back you've earned at the end.

Compare Umbrella Insurance Quotes

Once a policy's limit is reached, commercial umbrella insurance provides additional coverage for liability claims made on general liability, commercial auto, or. At low cost, you can buy significant extra liability coverage via umbrella insurance So you'll want to compare quotes carefully. What Doesn't Umbrella. We help you find and compare umbrella liability insurance quotes, made to match your needs. Request a call Compare, shop and customize quotes. A State Farm® Personal Liability Umbrella Policy may provide the additional liability coverage you need to help protect your financial future. Get a Quote from. Gabi's umbrella insurance quotes and cost comparison tool helps you find the best deal for your insurance. Shop auto & umbrella policies today with Gabi. An umbrella policy offers liability protection beyond the limits of your other personal insurance policies. If something happens and you're held financially. Get a customized umbrella insurance quote from a local independent insurance agent. Learn about coverage options and the best way to save on your policy. If you're an agent/broker looking for a customer quote for personal umbrella insurance, use our producer portal. am best logo Wards 50 logo. Glassdoor. When you get an umbrella insurance quote through Progressive, you can choose up to $5 million in added liability protection on your umbrella insurance policy. Once a policy's limit is reached, commercial umbrella insurance provides additional coverage for liability claims made on general liability, commercial auto, or. At low cost, you can buy significant extra liability coverage via umbrella insurance So you'll want to compare quotes carefully. What Doesn't Umbrella. We help you find and compare umbrella liability insurance quotes, made to match your needs. Request a call Compare, shop and customize quotes. A State Farm® Personal Liability Umbrella Policy may provide the additional liability coverage you need to help protect your financial future. Get a Quote from. Gabi's umbrella insurance quotes and cost comparison tool helps you find the best deal for your insurance. Shop auto & umbrella policies today with Gabi. An umbrella policy offers liability protection beyond the limits of your other personal insurance policies. If something happens and you're held financially. Get a customized umbrella insurance quote from a local independent insurance agent. Learn about coverage options and the best way to save on your policy. If you're an agent/broker looking for a customer quote for personal umbrella insurance, use our producer portal. am best logo Wards 50 logo. Glassdoor. When you get an umbrella insurance quote through Progressive, you can choose up to $5 million in added liability protection on your umbrella insurance policy.

An umbrella insurance policy provides up to $5 million in additional liability coverage. Get an umbrella insurance quote from Mercury to stay protected. Personal Umbrella Insurance may be the least expensive policy that you purchase ranging from about $ to $ per $1 Million in coverage. (Note: Rates vary. Compare umbrella insurance, surety bonds, liquor liability, and more from trusted insurance companies, and buy online in minutes. Get an umbrella insurance quote from Liberty Mutual for additional liability coverage that goes beyond the limits of home and auto policies. Get a quote. Umbrella insurance provides extra liability coverage that can help protect assets, such as your home, car, boat and investments. Get a free quote today. We help you find and compare umbrella liability insurance quotes, made to match your needs. Request a call Compare, shop and customize quotes. With a Contractors Liability umbrella policy, you can get up to $10 million of liability protection over and above the limits of other insurance policies. Umbrella insurance extends your homeowners and auto insurance protection by providing additional liability coverage. You can purchase it on top of your. Compare the Best Car Insurance Companies. Get personalized quotes from top + auto insurers in minutes. Enter your ZIP code. View My Quotes. Umbrella insurance provides additional liability coverage — over and above the limits on your auto and other personal liability policies. Umbrella insurance is a personal liability insurance that will help protect you if you're found liable for a claim that exceeds the coverage limits on your. What's the difference between liability and indemnity insurance? What do liability policies cover? Do you need an umbrella policy? Umbrella insurance can give you $1 million in coverage** on top of your auto or homeowners policy limits. If you injure someone or damage their property, you. The umbrella insurance coverage insures you above the liability limits of those policies so that a serious accident doesn't cause serious financial consequences. This guide breaks down how umbrella insurance works and how you should comparison shop for umbrella insurance companies. The cost of Personal Umbrella Insurance depends on your coverage limits; number of vehicles, residences, boats, etc. that you own; and your location. The. When you bought your car, home, or renters insurance, you probably chose the best policy you could afford to protect yourself and your assets. So, what. 1. Assess the value of your assets · 2. Request and compare quotes from several insurance companies · 3. Determine how much coverage you'll need and then apply. Coverage for the Unexpected. An umbrella policy provides additional liability coverage and can give you added protection for covered claims where the damages or. Umbrella rates depend on number of vehicles, drivers, and houses, driving & claim record, credit score, and location. While *most* umbrellas I'.

1 2 3 4 5